We’re grateful to our private wealth colleagues Neil Davies, CPWA®, Molly Powers, CFP®, and Carrie Walters Shapiro, CFP®, for leading this program. They opened the discussion by emphasizing the importance of having a comprehensive financial plan, which serves as a roadmap for making informed financial decisions today and in the future.

Remember: A goal without a plan is just a wish!

And speaking about the future, 2025 is just around the corner, and there are still plenty of financial opportunities to save, invest, gift and give in 2024. The fourth quarter is a great time to make sure you are using your opportunities to make tax-efficient decisions to optimize your finances. It’s also typically the annual re-enrollment period for many employer benefits, including for executive benefit plans.

Whether you’re assessing your benefit plans, updating your financial plan, preparing for an annual meeting with your advisor, or expecting a major life event like retirement, clear communication with a partner/spouse is key! For anyone in a relationship, including second marriages, regular and transparent conversations about your finances should be a priority, whether you manage your assets separately or together. Sharing financial information can help you better manage your household financial risks, especially if you file your taxes jointly and manage your finances separately. Openly talking about money can also reduce potential financial uncertainty and empower you to move together with greater clarity and confidence.

Here is the replay, and below is a year-end checklist to get you started!

KEY PROGRAM TAKEAWAYS

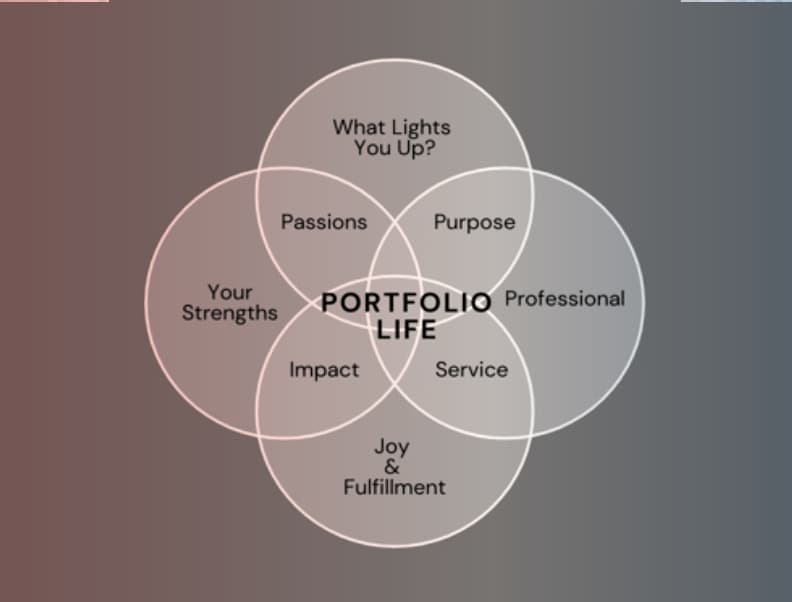

The diagram above outlines key action items covered in the program, showing various ways to save, invest, and minimize taxes before year-end. We encourage you to set aside time to review these categories to evaluate what options you might want to take advantage of, and be sure to reach out to your advisors, who should help you with these decisions.

IT STARTS WITH A CONVERSATION…

We hope this program inspires you to ACT and encourages you to confirm that you are making the most of your financial opportunities – to help make the most of this one precious life.

To invest in a conversation to review your financial plan, create one, learn more about how these opportunities apply to your specific financial life, please contact us. We are excited to talk through your financial life to help ensure the strategy and resources you have in place are creating the success and outcomes you desire.

It all starts with a conversation. Our contact information is below.

| Barbara Best Principal, CAP STRAT Founder, CAP STRAT Women’s Forum o. 630-318-0693 c. 312-952-9522 | Nancy Rizzuto Principal, CAP STRAT Founder, CAP STRAT Women’s Forum o. 561-260-5481 c. 201-602-8184 |

OUR SPEAKERS

Neil Davies, Principal. Is a Certified Private Wealth Advisor® (CPWA®) and leads the firm’s private wealth practice. He advises individual clients on various topics related to wealth management including investment advisory, retirement, and estate planning. Neil builds partnerships with our private clients with a strong focus on helping them articulate their goals and seek financial security. Neil focuses on wealth preservation, identifying tax-efficient strategies, and structuring low-cost portfolio solutions. He takes a collaborative, planning-based approach to client service, and works with clients’ legal and tax advisors to assure a more holistic wealth management strategy is considered. Neil also supports our institutional clients by working with executives on their personal wealth strategies.

Neil Davies, Principal. Is a Certified Private Wealth Advisor® (CPWA®) and leads the firm’s private wealth practice. He advises individual clients on various topics related to wealth management including investment advisory, retirement, and estate planning. Neil builds partnerships with our private clients with a strong focus on helping them articulate their goals and seek financial security. Neil focuses on wealth preservation, identifying tax-efficient strategies, and structuring low-cost portfolio solutions. He takes a collaborative, planning-based approach to client service, and works with clients’ legal and tax advisors to assure a more holistic wealth management strategy is considered. Neil also supports our institutional clients by working with executives on their personal wealth strategies.

Neil is a graduate of Illinois State University and holds a BS in Finance.

Molly Powers, Certified Financial Planner™ (CFP®) and Private Wealth Associate advising individuals and families on various topics related to retirement, wealth accumulation and preservation. Molly also conducts one-on-one and group educational meetings for institutional clients’ employees and pre-retirees.

Molly Powers, Certified Financial Planner™ (CFP®) and Private Wealth Associate advising individuals and families on various topics related to retirement, wealth accumulation and preservation. Molly also conducts one-on-one and group educational meetings for institutional clients’ employees and pre-retirees.

Molly graduated with a Bachelor of Science majoring in Recreation, Sports, and Tourism from the University of Illinois at Urbana-Champaign.

Carrie Walters Shapiro Certified Financial Planner™ (CFP®) and Private Wealth Associate advising individuals and families on various topics related to retirement, wealth accumulation and preservation. Carrie also conducts one-on-one and group educational meetings for institutional clients’ employees and pre-retirees.

Carrie Walters Shapiro Certified Financial Planner™ (CFP®) and Private Wealth Associate advising individuals and families on various topics related to retirement, wealth accumulation and preservation. Carrie also conducts one-on-one and group educational meetings for institutional clients’ employees and pre-retirees.

Carrie graduated with a Bachelor of Arts in Psychology (and a Certificate in French) from the University of Wisconsin’s College of Letters and Science.

Please let us know if you would like to have a conversation with us. Email the CAP STRAT Women’s Forum with any questions at womensforum@capstratig.com! Or call us at 630.320.5100.