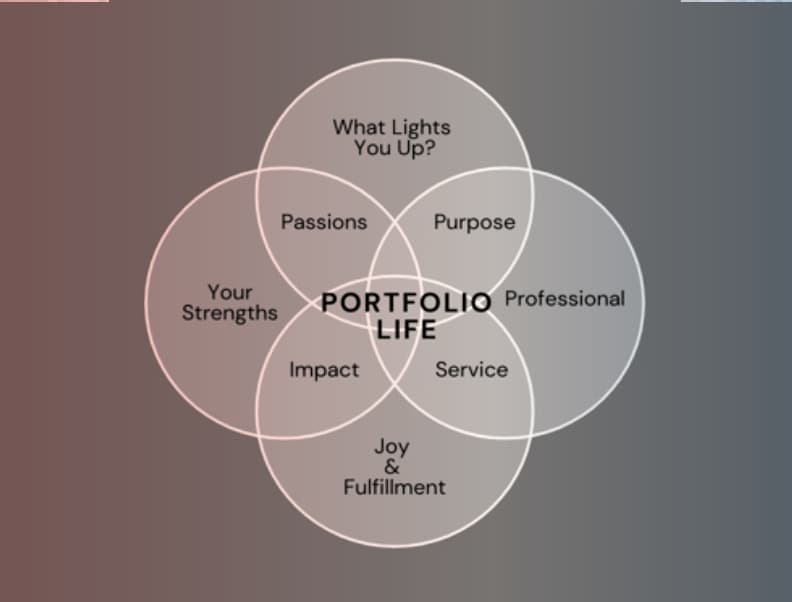

We have many years ahead of us to plan for! Envision the life you want to live post-career. While the content is relevant to all women, this program was specially created for women looking towards their post-professional lives – not “retirement”. For some women, this could be leaving a traditional career to consult, do paid or NP board work, teach, travel more, or pursue other hobbies or interests.

We are pleased to share the recap from our March 2022 Women’s Forum program: Financial Strategies to Support your Brilliant Life.

Your Post-Professional Life – Not Retirement

It’s an important topic to address because we all need to be deliberate in our actions to create our life goals paired with a financial plan that allows us to achieve these goals and sustain us through our lifetime – to live what we call our brilliant lives.

During the program, we addressed three specific topics women should think through, especially as they are within 10-years of pivoting from their traditional careers. We discussed:

- Identity. Who will you be without your title, without daily routines, and interactions with colleagues and clients? It’s important to evaluate what might replace this aspect of your identity in your post-career life.

- Time. Research shows one in three women who celebrate their 65th birthday will also celebrate their 90th. This means we have a lot of years to plan for! So how will you use this time? Identifying your key values can help you gain clarity around whether your behaviors and actions are aligned with them. And if not, what changes might you want to make to live a life that more fully expresses your values?

- The Importance of a Financial Plan. Can you imagine getting in your car to go on vacation and not using a GPS to identify the best route to get there? With something so important as our freedom and ability to fulfill our life and legacy goals, we must invest the time to create and follow a financial plan – at any time in of our lives. A financial plan is your financial GPS to creating a brilliant life.

Now is the time to ACT.

As author Dan Pink, discovered during his research, people regret what they didn’t do more than what they did do. Regrets of inaction are far more significant than regrets for actions taken. Don’t regret what you didn’t do because you were afraid to make the change or leap into something new.

We encourage you to watch the programme. Also, the downloadable Values Worksheet (PDF) we referenced during the program was shared by Dr. Lauren Hodges and can be a helpful tool as you explore your own personal values. On our resources page, you can find additional information to help you gain more knowledge, to help you create a financial plan and a life plan so you can live a more abundant and brilliant life!

Financial and Life Planning Resources

CAP STRAT

Invest in a conversation

Articles and Books

The Upside of Feeling Uncertain About Your Career: HBR 2022

Three Phases of Making a Major Life Change: HBR 2021

How to Plan for Your Next Act: Chief 2021

Simple Abundance by Sara Ban Breathnach

Ted Talks and Conversations

Happiness in the Second Half of Life with Arthur Brooks

How to Overcome Fear, Ted Talk with Trevor Ragan

Intentional Pause Project by Kim Alexis Newton

Purpose and Longevity

Values Worksheet (pdf) by Dr. Lauren Hodges

Other Resources

Your retirement plan’s website

Existing advisory relationship

HerMoney.com with Jean Chatzky

Please let us know if you would like to have a conversation with us. Email the CAP STRAT Women’s Forum with any questions at womensforum@capstratig.com! Or call us at 630.320.5100.