One of the important steps we take during our career is to save and invest for the future so that we have the freedom to pursue “what’s next” on our own terms. There are so many possibilities, and plenty of excitement as we dream about and plan for this next chapter in our life.

How do we navigate this journey? What questions will we need to ask – and answer? What decisions will need to be made?

These are the issues we explored in our October 2023 program: Enjoying Financial Freedom | The Power to Pursue What’s Next.

This program was created for women looking at “what’s next” for them, especially those looking towards their post-professional lives – NOT necessarily retirement.

The Three Essentials of Financial Success

There are 3-essentials that women can’t ignore nor allow inertia to limit their actions that curtail their financial success:

- To be the boss of your money. We don’t need to be experts, but we can’t give up our seat at the table – with our spouse and advisor.

- To be deliberate in your actions, and have a financial plan that is integrated into a life plan so you can live the life you want with greater peace of mind.

- To look ahead and be aware of what’s next. As we age, there are new questions to answer, more decisions to make, and opportunities to proactively grow and protect our wealth.

This journey in front of us, as we pivot into “what’s next” is filled with many unanswered questions, like how will I:

- Maintain connection and community.

- Stay engaged and feel relevant.

- Remain mobile and self-sufficient.

- Remain mentally sharp, physically and spiritually healthy…to name a few.

And decisions, like:

- Where do you want to live?

- Who do you want to spend time with?

- Will you want to earn some income – will you need to?

- Where will my contribution to our expenses come from?

The Two Steps To Take Today

- Complete this Values Worksheet and corresponding questions: Living Into Our Values by Brené Brown (podcast and PDF with values and questions)

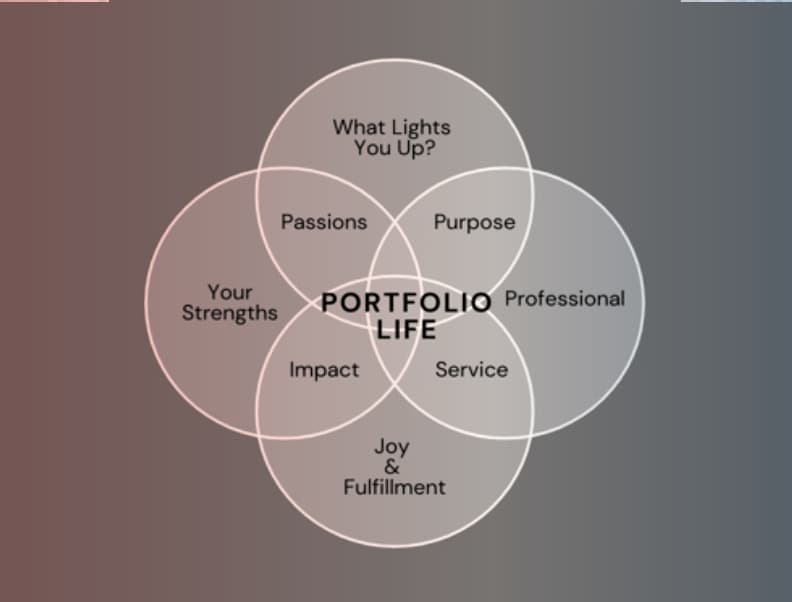

- Explore your Skills and Strengths. Create a list of your skills and the things you’re great at doing and think through how you can apply them in new and different ways during and beyond your transition. And discuss these with a trusted advisor or friend to gain their perspective.

Carving out the time to do this and not getting caught up in the busyness of life can be hard, but it is important to avoid future regret.

Evaluating Your Finances

The next step is where the rubber hits the road – the big question is:

Will you be able to sustain your desired lifestyle, generate a sufficient income throughout your lifetime, and not outspend your wealth?

THE VALUE OF A FINANCIAL PLAN – Getting clear on our purpose and what we want our future lives to look like will also require us to determine if we have the financial resources to support our life goals and this transition.

Take action:

Make sure you have transparent and regular conversations about your life plan and finances when you and your partner/spouse are healthy and can make decisions together.

If you are unpartnered, it is essential to address important issues with trusted family/friends while you are still in good health.

Use a holistic approach to managing your wealth, NOT silos: investments, taxes, estate planning, financial plan. Work with an advisor who can manage these issues AND orchestrate with other experts when needed.

The wealth accumulation phase of life is straightforward compared to what follows. Will the same approach, and the tools and resources we use today be enough to successfully guide us through your more complex next phase? We must determine:

- With a reduced income from a career, how do I choose to create income to cover expenses? Will it be enough to support my desired spending?

- When should I take social security?

- How do I minimize taxes?

- How will I pay for healthcare? What Medicare plan(s) should I use?

- Have my ideas about legacy changed? Is my estate plan up to date?

…and the list goes on!

Be sure to watch the video to gain more insights into the decisions and actions we highlight during the program so you can rest assured that you will be able to create and enjoy your desired financial freedom.

Resources

Below are the resources we referenced during the program.

CAP STRAT

- Invest in Yourself. Reach out to us for a conversation.

- CAP STRAT Website for financial education and market outlook

- CAP STRAT Women’s Forum website: programming, videos, podcast

- CAP STRAT YouTube Channel

Articles and Books

- From Strength to Strength Arthur Brooks

- How to Plan for Your Next Act: CHIEF 2021

- Three Phases of Making a Major Life Change: HBR 2021

- The Power of Regret, by Dan Pink

Ted Talks and Conversations

- How to Overcome Fear TED Talk with Trevor Ragan

- Build The Life You Want Conversation with Arthur Brooks and Oprah Winfrey

A Final Message

We hope this program inspired you to take ACTion to explore your identity outside of work, assess your alignment to your values and purpose, and inspire you to dust off that financial plan to help you align your vision of your life and legacy to your financial resources.

Please reach out to us if we can help you explore any of these issues and move forward with greater intention and peace of mind.

Please let us know if you would like to have a conversation with us. Email the CAP STRAT Women’s Forum with any questions at womensforum@capstratig.com! Or call us at 630.320.5100.